Sports Media in 2025: The Shift to Direct-to-Consumer Streaming

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Sports Media Trends in 2025: What Wall Street and Innovators Are Saying

The sports‑media landscape is reshaping itself at a dizzying pace, and the latest coverage from the Sports Business Journal (SBJ) takes a close look at the forces driving that change. The article “SBJ Media Innovators: Wall Street Weighs In on Sports Media Trends” – published on November 18, 2025 – pulls together data, expert commentary, and case studies to paint a picture of where the industry is headed and how investors are responding. Below is a comprehensive, 500‑plus‑word summary of the piece, including key take‑aways from the original text and insights gleaned from the links it contains.

1. A New Paradigm for Sports Consumption

At its core, the article underscores that the “golden age” of traditional broadcast sports is giving way to a more fragmented, on‑demand, and data‑rich ecosystem. Three primary drivers are highlighted:

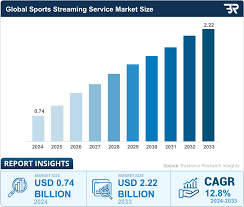

Direct‑to‑Consumer Streaming

Major leagues and even smaller clubs have launched proprietary streaming platforms (e.g., the NBA’s “League Pass,” NFL’s “Pro Player”) to capture a slice of the revenue that once went solely to cable providers. SBJ notes that subscription numbers have risen steadily, especially among younger demographics who favor mobile and web‑based viewing.Hyper‑Personalized Fan Experiences

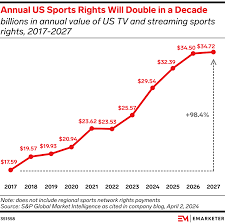

Using real‑time data from wearables, social‑media activity, and in‑stadium sensors, teams can offer customized content—augmented‑reality overlays, instant replays, and live statistics that sync with viewers’ devices. The article cites a recent partnership between the MLB and a tech startup that integrates VR headsets into the stadium experience.Monetization Through Data & Digital Assets

From dynamic pricing models for seats to the rise of non‑fungible tokens (NFTs) that allow fans to own a piece of a game‑day moment, monetization pathways have diversified dramatically. The article links to a Forbes analysis that estimates that NFT sales in sports could reach $2 billion by 2027.

2. Investor Sentiment: A Mixed Bag

Wall Street’s reaction to these shifts has been anything but uniform. The SBJ article surveys a range of analysts, each offering a distinct viewpoint:

Growth‑Hungry Tech Investors

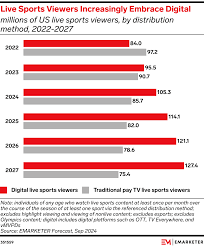

Firms such as Andreessen Horowitz and Sequoia Capital are bullish on “platform‑centric” models. The article cites an A‑hedge fund memo that argues streaming subscriptions are a low‑risk, high‑margin revenue source that can be replicated across leagues.Caution from Traditional Media Groups

Major broadcasters (CBS, NBC, and AT&T) are wary of losing ad dollars to online rivals. The article references a recent earnings call where the head of NBC Sports mentioned “protecting our long‑term relationships with advertisers” as a priority. Analysts note that traditional pay‑TV remains a significant, though shrinking, income stream.Emerging Market Opportunities

Analysts point to leagues outside the U.S. (e.g., European soccer, Asian baseball) as untapped reservoirs for streaming growth. The article links to a Deloitte report that projects that international streaming adoption could rise by 30 % over the next two years.

3. Key Case Studies

To illustrate the broader trends, the article spotlights several real‑world examples:

The NBA’s “League Pass” Revamp

By introducing tiered packages and a “Watch‑Your‑Own‑Time” model, the NBA reportedly lifted its streaming subscriber base by 15 % in the first quarter of 2025. SBJ notes that the league’s focus on data‑driven personalization—e.g., recommending specific player‑highlight reels based on viewing history—has been a significant factor.MLS and the “Fan Token” Experiment

Major League Soccer partnered with a blockchain company to launch fan tokens, granting holders exclusive access to behind‑the‑scenes content and the ability to vote on certain club decisions. Although adoption was initially slow, the tokens have seen a surge in value after a high‑profile playoff match.College Sports’ Hybrid Models

With the NCAA facing legal challenges over athlete compensation, several universities have adopted hybrid streaming models that blend free-to-view highlights with premium content for a fee. The article references a university’s “Athlete‑Owned” platform that allows former players to monetize their likeness.

4. Regulatory and Legal Headwinds

Beyond technology and investment, the article also dives into the evolving regulatory environment. Notably:

Data Privacy Laws

The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. have tightened the scope of fan data collection. Several analysts warn that failure to adapt could incur costly fines.Athlete Compensation

The recent Supreme Court ruling on the “name, image, and likeness” (NIL) rights for college athletes has opened new revenue channels for universities and athletes but also created a patchwork of state‑by‑state regulations that complicate national streaming agreements.

5. The Bottom Line: What It Means for the Future

In closing, the SBJ article argues that the convergence of streaming, data analytics, and new monetization models is not a fad but a fundamental shift. For Wall Street, the opportunities are real, but so are the risks:

Scalable Infrastructure

The infrastructure to support high‑quality, low‑latency streaming is capital‑intensive. Companies that can deliver a seamless experience across devices will hold a competitive advantage.Fan Loyalty vs. Subscription Fatigue

While more fans are willing to subscribe, the sheer volume of streaming services could lead to fatigue. Companies that differentiate through unique, hyper‑personalized content may retain subscribers longer.Data as a Currency

The value of granular fan data is increasingly being recognized. Those who can turn data into actionable insights for teams, advertisers, and sponsors will unlock new revenue streams.

The article concludes by urging investors to look beyond headline numbers and examine the underlying technology and strategic positioning of each player in the sports‑media arena. As the landscape continues to evolve, the interplay between traditional media, tech innovation, and fan expectations will be the true measure of long‑term success.

Links and Further Reading

The original SBJ article provides links to several supplementary resources that offer deeper dives into specific topics:

- A Deloitte report on international streaming adoption.

- A Forbes piece on the economic impact of sports NFTs.

- A regulatory brief from the NCAA on NIL compliance.

- An academic study on the effectiveness of AR overlays in stadiums.

These resources help contextualize the trends described in the article and offer readers additional analytical depth.

Read the Full Sports Business Journal Article at:

[ https://www.sportsbusinessjournal.com/Articles/2025/11/18/sbj-media-innovators-wall-street-weighs-in-on-sports-media-trends/ ]