Enhanced Games to Launch Performance Enhancers and Go Public on Nasdaq

Locale: New York, UNITED STATES

New York‑based “Enhanced Games” Plans to Offer Performance‑Enhancing Products and Take a Slice of the Public Market

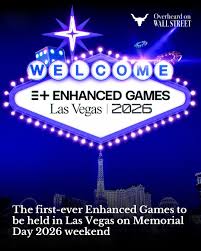

A small biotech start‑up headquartered in Westchester, New York, is preparing to move from a niche player in the sports‑performance arena to a publicly traded company. According to a recent AP‑sourced story highlighted by WNYT, the firm—named Enhanced Games—has announced that it will soon launch a line of “performance enhancers” and simultaneously offer its shares to the public through a direct‑listing on the Nasdaq exchange.

What the company actually does

Enhanced Games began in 2019 with a very specific vision: to develop scientifically validated, regulated supplements that help athletes and other high‑performance consumers recover faster, maintain higher muscle mass, and stay at the top of their game without resorting to banned substances. In short, the company’s flagship product is a proprietary blend of ingredients that the founders say work on the same mechanisms as some of the most popular legal supplements on the market, but with better bioavailability and a longer half‑life.

The most‑publicized product, currently still in late‑stage clinical trials, is called “E‑Boost.” E‑Boost is a nootropic‑derived supplement that contains a combination of natural stimulants, adaptogens, and amino acids. The goal is to provide an edge in both physical and cognitive domains for athletes, endurance runners, and even everyday consumers who want a boost to their mental acuity.

In addition to E‑Boost, the company plans to launch a second line called “E‑Gain,” a post‑workout formula that combines L‑glutamine, BCAAs, and a patented peptide to help muscles recover more quickly. The duo, the company claims, offers a “complete performance stack” that supports both the mind and the body.

The funding story

According to the article, Enhanced Games recently closed a $75 million Series B round, led by the venture capital firm Oakridge Ventures, with participation from several other angel investors. The funding will be used primarily for expanding the clinical trials, scaling the manufacturing footprint, and creating a marketing engine that will target the rapidly growing “performance‑enhancement” sector.

“Performance enhancement is a $10 billion market that is only now beginning to unlock the potential of science‑backed, FDA‑approved products,” said CEO and co‑founder Maya Radhakrishnan, according to the article. “We’re poised to meet the demand for legal, evidence‑based performance aids, and going public will accelerate that growth.”

The company’s board has indicated that it will be listed on Nasdaq under the ticker “EHG,” though the exact timing of the IPO is still under negotiation. The article notes that Enhanced Games’ board is also in discussions with a large financial institution to handle the listing logistics.

The regulatory landscape

One of the biggest risks for the company is the complex regulatory environment surrounding performance‑enhancing products. The Food and Drug Administration (FDA) has strict guidelines on what can be marketed as a supplement and what must go through the drug approval process. Enhanced Games claims that its products will be sold as dietary supplements, thereby falling under the more relaxed Dietary Supplement Health and Education Act (DSHEA) framework.

However, the company is also careful to note that it will not make any claims that could be interpreted as “drug‑like.” Instead, the marketing strategy emphasizes “natural performance support” rather than “synthetic enhancement.”

The article also highlights the ongoing tension between the World Anti‑Doping Agency (WADA) and companies that sell performance‑enhancing substances. While WADA’s list is focused on substances banned in sport, the company maintains that its products will be “completely compliant with anti‑doping regulations,” and that it has already begun consultations with sports federations to ensure its formulas stay on the safe side of the “therapeutic use exemption” (TUE) guidelines.

Potential controversies and market reactions

The venture’s rapid ascension is not without skepticism. A number of analysts expressed concern about the potential for the products to be misused by athletes looking to gain an unfair advantage, and whether the company’s claims will hold up under rigorous, independent peer review. The article references a comment from a former professional athlete who cautioned that “performance‑enhancers” could blur the line between “legitimate support” and “cheating.”

On the upside, the growing consumer market for “bio‑hacking” and nootropics could provide a sizeable customer base. The article quoted a market research firm that projected a 12‑year growth rate of 9.2% CAGR in the performance‑enhancement supplement segment, driven largely by younger consumers and a shift in attitudes toward legal enhancement.

The bigger picture

Enhanced Games’ announcement is part of a broader trend in which companies that produce performance‑enhancing products seek to become part of the public equity market. A growing number of consumer‑facing startups are looking to monetize their innovations by taking advantage of the deep liquidity and capital that public markets can offer.

For consumers and athletes, the key question remains: will these new products actually deliver the performance gains they promise, and can they do so safely? While Enhanced Games has committed to transparency and regulatory compliance, independent verification of its formulas will be critical. Moreover, the company’s willingness to engage with sports governing bodies could set a precedent for future collaborations between performance‑enhancement companies and the sporting world.

In any case, the company’s move toward a public listing is a bold step that could shake up the performance‑enhancement sector, potentially opening the door for other startups to follow suit. It will be interesting to see whether Enhanced Games can translate its current momentum into tangible performance gains for its customers and sustained financial success on the stock market.

Read the Full WNYT NewsChannel 13 Article at:

[ https://wnyt.com/ap-top-news/enhanced-games-to-offer-performance-enhancers-and-stock-to-the-public/ ]