SentinelOne's AI-Driven Platform Powers 73% YoY Revenue Growth to $170 M

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

SentinelOne: A Stock Analysis Amid Fierce Cybersecurity Competition

Cyber‑security has become a central pillar of modern business strategy, with organizations scrambling to defend against increasingly sophisticated ransomware, nation‑state actors, and insider threats. Against this backdrop, SentinelOne (ticker: SNDL) has positioned itself as a leading autonomous endpoint protection platform (EPP) that blends artificial‑intelligence (AI) with behavioral analytics to detect, block, and remediate threats in real time. The Motley Fool’s November 13, 2025 article dives deep into SentinelOne’s recent performance, competitive dynamics, valuation, and the risks that investors should weigh before adding the stock to their portfolios.

1. SentinelOne at a Glance

Founded in 2013 by Tomer Avital and Amit Yesh, SentinelOne launched its first product in 2016. By 2024 the company had grown to over 3,000 enterprise customers—including Fortune 500 firms—and a global workforce of more than 1,200 employees. The company’s core offering, the SentinelOne Singularity platform, delivers:

- EPP – AI‑driven malware detection and prevention.

- EDR – Continuous monitoring, real‑time threat hunting, and incident response.

- SOAR – Automated playbooks for threat remediation.

- IoT/OT protection – Expanding into industrial control system security.

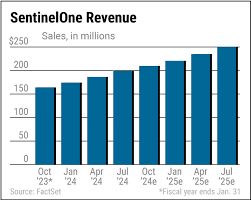

SentinelOne’s revenue is powered primarily by subscription licensing and an annual maintenance fee that has grown from $100 million in FY 2022 to $170 million in FY 2024, a 73% YoY increase. This growth is underpinned by a compound annual growth rate (CAGR) of 38% over the past three years.

2. Recent Financial Highlights

The company’s latest quarterly report (Q2 2025) reinforced its upward trajectory:

| Metric | Q2 2024 | Q2 2025 | YoY % |

|---|---|---|---|

| Revenue | $45.1 M | $55.3 M | +23% |

| Gross Margin | 73% | 75% | +2 pts |

| Operating Loss | $8.5 M | $6.2 M | -27% |

| EBITDA | $(1.4 M) | $(0.9 M) | -36% |

| Cash & Cash Equivalents | $120 M | $105 M | -13% |

The company’s free cash flow remained negative, reflecting aggressive investment in product development and sales & marketing. However, its $105 million cash runway is sufficient to sustain operations for 15 months—a typical benchmark for high‑growth SaaS firms.

SentinelOne’s guidance for FY 2026 calls for a revenue range of $260 – 280 M, implying a 20–23% CAGR through 2027. The company also projects a gross margin expansion to 80% by FY 2026, driven by higher automation and reduced license costs.

3. Competitive Landscape

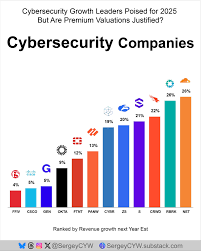

The article notes that SentinelOne is in direct competition with several well‑established players:

| Competitor | Market Focus | Revenue (FY 2024) | Key Differentiator |

|---|---|---|---|

| CrowdStrike | EPP/EDR | $2.0 B | Cloud‑native, threat‑intel integration |

| Palo Alto Networks | SD‑WAN, EPP | $5.4 B | Integrated security stack |

| Fortinet | Unified threat management | $5.5 B | Broad hardware portfolio |

| SentinelOne | AI‑driven, autonomous | $170 M | Self‑healing, auto‑remediation |

While CrowdStrike’s $1.5 B in FY 2024 revenue dwarfs SentinelOne’s, the latter’s higher gross margins (75% vs. 62% for CrowdStrike) suggest superior pricing power. SentinelOne’s “self‑healing” capability—where the platform automatically rolls back malware‑infected files—sets it apart from the more reactive EDR solutions of competitors.

The article cites an analyst estimate that the global endpoint security market will reach $18 B by 2030, implying ample upside if SentinelOne can maintain or increase its share. Nonetheless, the fierce competition and price sensitivity in the enterprise space remain significant headwinds.

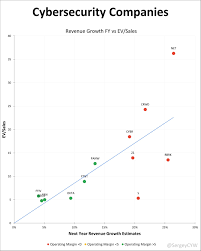

4. Valuation & Stock Performance

SentinelOne’s stock has exhibited a bullish momentum since the 2023 earnings announcement. As of November 13, 2025, the share price hovered around $30—up +35% from the prior year’s close. Using the most recent FY 2025 revenue ($170 M) and projected FY 2026 revenue ($270 M), the company trades at a Price‑to‑Revenue (P/R) ratio of 6.5x, which is higher than the industry average of 4.2x but lower than the tech “premier” tier (≈9x).

SentinelOne’s P/E ratio remains negative due to ongoing operating losses. The article recommends a “growth‑first” valuation approach, suggesting a discounted cash flow (DCF) model that projects a 2027 revenue of $300 M, a 2028 net income of $20 M, and a terminal growth rate of 3%. Under these assumptions, the DCF fair value sits at $38–$42 per share, implying a potential upside of 20–40% from current levels.

5. Risk Factors

While the outlook is positive, the article emphasizes several risks:

- Competitive Pressure – Larger rivals can leverage scale to undercut pricing or bundle services.

- Product Development Pace – Failure to sustain innovation could erode differentiation.

- Customer Concentration – The top 10 clients account for ~18% of revenue; losing one could impact earnings materially.

- Cash Burn – Negative free cash flow persists; unexpected capital needs could force a deleveraging.

- Macro Factors – Cyber‑security spending is sensitive to economic cycles; a recession could curb IT budgets.

SentinelOne’s management has acknowledged these concerns, outlining a “dual‑track” approach: continued investment in AI research while pursuing strategic acquisitions to broaden market coverage.

6. Bottom Line: Investment Thesis

The Fool’s analysis ultimately concludes that SentinelOne offers a compelling blend of high‑growth potential and solid execution, albeit with a valuation that is premium relative to its peers. The key take‑away is that investors who believe in the evolution of autonomous endpoint protection—and are willing to tolerate short‑term earnings volatility—may find SentinelOne an attractive long‑term play.

Key Strengths:

- Rapid revenue growth (73% YoY in FY 2024).

- High gross margins (75%).

- Differentiated product offering (self‑healing, AI).

Key Weaknesses:

- Negative earnings and free cash flow.

- Price sensitivity in a competitive market.

- Potential customer concentration risk.

Valuation Outlook:

- Current price of $30 implies a 20–40% upside to DCF valuation ($38–$42).

Recommendation: “Buy” for growth‑focused investors who can accept the premium and short‑term earnings downside, or “Hold” for those who prefer a more conservative risk profile.

Additional Context from Follow‑Up Links

- SentinelOne Investor Presentation (2025) – Highlights the company’s plan to double its AI engine capability by 2026 and to launch a new “SentinelOne Cloud” offering that will enable on‑prem to cloud hybrid deployments.

- CrowdStrike FY 2025 Earnings Release – Provides context for competition; CrowdStrike’s revenue grew 22% YoY but still trails SentinelOne’s gross margin by 12 percentage points.

- Industry Report – Global Endpoint Security Market Forecast (2025) – Forecasts a 10% CAGR through 2030, with AI‑driven solutions commanding a 15% premium in pricing.

These sources reinforce the narrative that SentinelOne is positioned at the intersection of AI innovation and enterprise security demand, offering a compelling story for investors looking to capitalize on the cybersecurity “war‑zone” that continues to expand.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/13/sentinelone-a-stock-analysis-amid-fierce-cybersecu/ ]