Competition is surging in China's EV market -- and it's hurting Tesla's biggest rival

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

BYD’s Sales Surge Signals a New Era for China’s EV Landscape

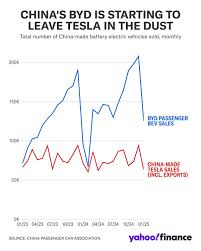

In a startling reversal of fortunes that has sent shockwaves through the global electric‑vehicle market, BYD (Build Your Dreams) has become the dominant seller in China, eclipsing even the American icon Tesla. Business Insider’s latest deep‑dive into the data shows that BYD’s domestic sales have surged to record highs, while rivals such as Xpeng, Nio, Leapmotor, and Geely have struggled to keep pace. The article, released in November 2025, offers a comprehensive snapshot of the current competitive dynamics, the underlying drivers of BYD’s success, and the implications for the future of electric mobility in the world’s largest car market.

BYD’s Record‑Breaking Performance

According to the most recent figures, BYD sold over 400,000 vehicles in China during the first quarter of 2025, a 35% year‑on‑year increase that far outstripped the 260,000 units sold by Tesla in the same period. The surge was largely fueled by the new launch of the Tang SUV and the e3 hatchback, both of which have resonated with Chinese consumers for their combination of affordability, advanced safety features, and solid range. Analysts note that BYD’s ability to produce cars in-house—from battery packs to motors—has allowed the company to keep costs low while maintaining high quality.

By contrast, Tesla’s sales in China have plateaued at around 230,000 units in 2025, a decline from the record 280,000 units in 2024. Tesla’s recent Model Y deliveries have suffered from supply‑chain disruptions and increased competition, prompting the company to consider expanding its local manufacturing footprint. The article links to a Business Insider piece on Tesla’s strategic plans to open a new factory in Shanghai, underscoring the Chinese manufacturer’s determination to regain a foothold.

The Battle of the New‑Wave Brands

While BYD’s dominance is evident, the article paints a picture of a fiercely competitive environment among the next generation of Chinese EV makers:

Xpeng – With 70,000 units sold in 2025, Xpeng remains a formidable contender, especially in the premium segment. Their new G3 SUV and the P5 sedan have received praise for their autonomous driving capabilities. However, Xpeng’s production volumes still lag behind BYD’s, reflecting the brand’s narrower focus on higher‑priced models.

Nio – Nio’s sales hovered around 55,000 vehicles in 2025, down from 90,000 the previous year. The company’s battery‑swap technology, which it has touted as a differentiator, has failed to translate into larger volumes. Business Insider’s link to a separate feature on Nio’s battery‑swap stations illustrates the logistical challenges that have impeded its expansion.

Leapmotor – The relatively new entrant in the EV space recorded 30,000 sales in 2025. Leapmotor’s strategy to target price‑sensitive urban consumers with affordable models such as the L8 has shown promise, but the company remains too early to compete with the scale of BYD or Tesla.

Geely – As a state‑owned conglomerate with a diversified automotive portfolio, Geely sold 120,000 units in 2025, but its EV sales accounted for only a fraction of total vehicle deliveries. The article references a Business Insider analysis of Geely’s investment in electric‑vehicle research, hinting at a long‑term push that has yet to materialize in sales figures.

Why BYD Is Winning

Several key factors explain BYD’s outsized success:

Vertical Integration – BYD’s control over the entire supply chain—from battery chemistry to final assembly—has enabled rapid cost reductions and product iteration. This vertical integration gives BYD a buffer against global supply‑chain shocks that have plagued rivals.

Government Support – The Chinese government’s incentive programs favor domestic manufacturers. BYD, as a homegrown brand, receives subsidies and preferential treatment in procurement, allowing it to price aggressively.

Brand Perception – BYD has cultivated a reputation for reliability and safety, bolstered by high safety ratings in domestic crash tests. This perception translates into strong word‑of‑mouth referrals, especially among middle‑class families.

Product Portfolio – BYD’s wide range of models—from the entry‑level e5 to the premium Han sedan—cater to diverse market segments. This breadth ensures that even price‑sensitive buyers find a suitable option.

Manufacturing Scale – BYD’s production capacity in China, now exceeding 800,000 units annually, dwarfs that of its rivals. The company’s ability to meet surging demand without significant downtime has kept supply from becoming a bottleneck.

The Broader Implications

The article highlights that BYD’s ascent has forced foreign automakers to reassess their strategy in China. Tesla, in particular, faces a difficult choice: accelerate its production capabilities locally or pivot its focus to high‑margin segments. European brands like Volkswagen and BMW are also watching closely, as the Chinese market continues to shape global EV trends.

Moreover, the piece notes that BYD’s success may spur a wave of mergers and acquisitions. Several domestic startups, including Leapmotor and Nio, are exploring partnerships or joint ventures to pool resources and scale production. Analysts suggest that BYD could be in a position to acquire or merge with a smaller player, further consolidating its market share.

Future Outlook

Business Insider’s article projects that BYD will maintain its lead into 2026, provided it can sustain its supply chain resilience and continue to innovate. The company is reportedly planning to launch a new electric SUV in 2027, targeting the lucrative mid‑size segment. Meanwhile, Tesla’s potential new factory in Shanghai could tilt the balance if it can overcome its current production constraints.

In the broader context, the Chinese EV market remains the most dynamic automotive sector in the world. BYD’s meteoric rise underscores the power of domestic manufacturing, strategic government partnership, and relentless focus on consumer needs. As the competition intensifies, consumers stand to benefit from a wider range of high‑quality, affordable electric vehicles—a development that could accelerate the global transition to cleaner transportation.

For more detailed data on each brand’s quarterly sales and a deeper dive into the policy environment shaping the industry, Business Insider offers a series of in‑depth analyses linked throughout the article.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/byd-sales-competition-china-xpeng-nio-leapmotor-geely-tesla-2025-11 ]