New York Lands at Bottom of Competitive-Taxes Ranking, Underscoring Tax Burden Challenges

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

New York Ranks Last in the Competitive‑Taxes Report: What It Means for Businesses and Residents

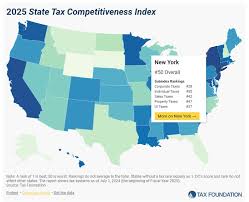

The Washington Examiner’s latest policy piece, “New York: Last in Competitive‑Taxes Report,” dives into a recent ranking that has state officials and policymakers scrambling for answers. According to a comprehensive analysis released by the Competitive Taxes project—a bipartisan initiative that evaluates how state and local tax policies affect economic competitiveness—New York sits at the bottom of a list that includes every U.S. state. The article explains the methodology behind the ranking, the specific tax burdens that pushed the Empire State to the end of the pack, and what the ranking could mean for its businesses, homeowners, and future tax policy.

How the Ranking Is Calculated

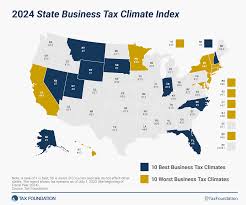

The Competitive Taxes project draws on a database of 13 key tax‑related metrics, ranging from corporate income and franchise taxes to property taxes and payroll taxes. Each metric is normalized for population and GDP, then weighted according to its perceived impact on economic decisions like locating new headquarters, hiring workers, and expanding production. States are then scored on a 0‑100 scale, with higher scores indicating a more business‑friendly tax climate.

In the latest report, New York scored 20.6 points, placing it 51st out of 51 states. The next lowest score belonged to Nevada at 23.9, while the top performers include Texas (70.2), Florida (68.3), and Washington (67.6). The Washington Examiner notes that the scoring system has been refined over the years to account for changes in tax law and economic conditions; however, New York’s ranking has remained stubbornly low, raising questions about the state’s tax architecture.

What Drives New York’s Poor Score?

The Examiner’s article identifies several key factors that push New York down the leaderboard:

High Property Taxes

New York has the nation’s highest property tax burden when measured as a percentage of total revenue, and the state’s average property tax is 1.28% of a property’s assessed value—well above the national average of 1.0%. The article highlights that this level of taxation disproportionately affects small and medium‑sized businesses, especially in urban centers like New York City and Buffalo.Corporate Income and Franchise Taxes

While New York’s corporate tax rate is officially 6.5% (with a 7% rate for larger corporations), the state also levies a separate franchise tax that can add a substantial burden. The Examiner points out that this double‑layered approach makes the state less attractive to large firms compared to tax‑friendly states such as Delaware or Nevada.High Sales Tax and Local Add‑ons

The combined state and local sales tax can reach 8.875% in New York City, the highest in the country. The article explains that this tax not only raises the cost of living but also reduces consumer spending power—a key driver of economic growth.Payroll Tax Overlays

New York imposes additional payroll taxes, including the Metropolitan Commuter Transportation Mobility Tax (MCTMT) and a payroll tax for the state’s unemployment insurance system. These overlays increase the cost of hiring for businesses and are cited as a major deterrent to expansion.Regulatory Burdens and “Tax Complexity”

Beyond sheer rates, the report highlights how New York’s tax code is notoriously complex. Multiple layers of municipal, county, and state taxes, combined with a plethora of exemptions and credits, can result in administrative costs that the article estimates in the billions each year.

A Look at the Competition

The Washington Examiner places New York’s performance in context by comparing it to states that consistently rank near the top. For instance, Texas’s low corporate tax rate (0% for corporations) and lack of a state sales tax make it a benchmark for a business‑friendly climate. The article references the Competitive Taxes project’s data, noting that Texas’s score of 70.2 is driven largely by the absence of property tax on business‑owned real estate and a simple tax structure that eases compliance.

Florida, on the other hand, uses a moderate corporate tax rate (5.5%) but offsets it with a lack of income tax and a relatively low sales tax. Washington state achieves a high ranking partly through its investment in technology‑friendly tax incentives, which the Examiner mentions as an example of strategic policy design.

Implications for Businesses and Residents

The article emphasizes that New York’s low ranking has tangible repercussions:

Business Relocation

Many companies are already moving operations out of New York to states with lower tax burdens. The Examiner cites an example of a Fortune 500 firm that announced a 2025 relocation of its headquarters from Manhattan to Atlanta, citing “tax competitiveness” as a key factor.Job Creation

Economists warn that higher taxes can dampen job creation. The Washington Examiner quotes a study by the National Bureau of Economic Research (NBER) that finds a one‑percentage‑point increase in state tax rates can reduce employment growth by 0.1% over a five‑year horizon.Housing Market Pressures

Higher property taxes have also contributed to affordability concerns. The article points to the City and County of Los Angeles report that New York’s property tax rate accounts for a significant portion of the cost of living premium in its urban cores.

What Can Be Done?

The article offers a series of recommendations from tax policy experts and state officials alike:

Reassess Property Tax Allocation

Simplify the tax base to reduce the percentage of revenue collected from property taxes, particularly on commercial real estate. Some experts propose moving a larger share of the tax burden onto corporate income.Unify the Corporate Tax Structure

Eliminate the separate franchise tax or align it more closely with the corporate income tax to reduce administrative complexity. Some policymakers suggest a “one‑size‑fits‑all” tax rate that is more competitive globally.Reduce Sales Tax Burden

Consider narrowing the geographic scope of local add‑ons or introducing a cap on combined state and local sales tax. This could help increase consumer spending without compromising essential revenue streams.Streamline Tax Administration

Adopt a unified filing system that reduces compliance costs for both businesses and individual taxpayers. The article cites the state of Montana’s initiative to centralize tax filing as a possible model.Implement Economic Incentive Programs

Offer targeted tax credits for innovation, research and development, and green energy initiatives. The Washington Examiner quotes an economic development analyst who believes that well‑structured incentives can offset the cost of a high base tax rate.

A Call for Dialogue

In its closing remarks, the Washington Examiner urges state leaders, business representatives, and taxpayers to engage in a candid dialogue about the trade‑offs between public revenue and economic competitiveness. “The Competitive Taxes report is a mirror,” the article concludes, “reflecting where New York stands in the national arena and challenging policymakers to rethink how best to balance the twin imperatives of fiscal responsibility and business growth.”

While the ranking may sting, it also provides a clear signal: New York must act if it wishes to stay relevant as a hub for innovation, employment, and consumer spending in an increasingly tax‑conscious world. The next chapter will see whether the state’s lawmakers heed that signal and design reforms that can lift the Empire State from the bottom of the leaderboard to a more competitive position—one that can attract and retain the businesses that fuel its economy.

Read the Full Washington Examiner Article at:

[ https://www.washingtonexaminer.com/policy/finance-and-economy/3885029/new-york-last-competitive-taxes-report/ ]