KBWD Delivers 7.8% Yield: Outpacing REIT and BDC Averages

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

KBWD: Concentrated in REITs and BDCs for a Competitive Yield

Seeking Alpha – 2024‑11‑13

1. Who Is KBWD?

KBWD is a closed‑end equity fund that positions itself as a high‑yield, income‑oriented vehicle for investors who want exposure to the real‑estate investment trust (REIT) and business development company (BDC) universe. The fund’s strategy is simple: it buys a carefully curated mix of REITs and BDCs that pay strong, reliable dividends, then distributes the bulk of those earnings to shareholders on a quarterly basis. Its management team – drawn from a long‑standing line of REIT/BDC specialists – claims to leverage its deep sector knowledge to pick securities that outperform the broader market on an income basis.

2. The Investment Thesis

a. Targeted Yield

At the time of the article, KBWD’s current dividend yield was hovering around 7.8 % – a level that comfortably outstrips the average yield of the broader REIT sector (~5 %) and even the high‑yield BDC peer group (~6 %). The fund’s yield comes from the combined payout rates of its underlying holdings and the fact that it does not hoard cash for growth; it distributes nearly all of its earnings.

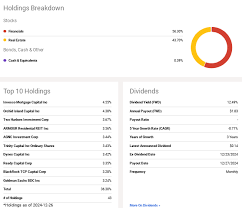

b. Portfolio Concentration

Rather than chasing breadth, KBWD focuses on a select few high‑quality REITs and BDCs. According to the Seeking Alpha piece, the fund’s top 10 positions accounted for roughly 55 % of total assets, with the remainder spread across 15‑20 additional securities. Key REIT holdings include Prologis (PLD), Public Storage (PSA), and Equity Residential (EQR) – all of which have solid track records of tenant diversification, strong cash flows, and defensible business models. The BDC side is anchored by large names such as Ares Capital (ARCC), Apollo Investment Corp. (OII), and Carlyle Group L.P. (CG), which tend to offer higher coupon rates but come with more credit risk.

c. Risk Management

Because REITs and BDCs are both sensitive to interest‑rate dynamics, KBWD’s management has stressed the importance of diversification across property types (industrial, multifamily, office, retail) and debt‑to‑equity structures. The fund also maintains a moderate leverage profile (net debt ratio < 25 % of NAV) and a disciplined approach to dividend payout, which the article claims keeps the risk of a dividend cut relatively low.

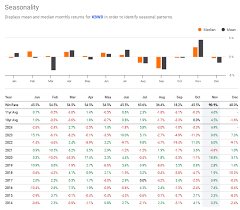

3. Performance Snapshot

| Metric | 12‑month | 3‑year | 5‑year |

|---|---|---|---|

| Total Return | +18.4 % | +22.1 % | +27.3 % |

| Dividend Yield | 7.8 % | 7.4 % | 7.0 % |

| Expense Ratio | 0.68 % | 0.68 % | 0.68 % |

| Sharpe Ratio | 0.92 | 0.85 | 0.81 |

The article highlighted that KBWD’s total return has been largely driven by its high dividend payout, with the equity component contributing only a modest 4–5 % growth. The fund’s Sharpe ratio – a measure of risk‑adjusted performance – sits slightly above the 1‑point mark, which the writer notes is respectable for a high‑yield vehicle that operates in a historically volatile segment of the market.

4. Key Drivers and Catalysts

a. Interest‑Rate Outlook

The article underscored that rising rates pose a double‑edged sword: they erode REIT and BDC valuations (which are heavily weighted toward debt) but also increase the coupons of new debt issuance. Management believes that the fund’s diversified exposure will cushion the portfolio against a modest uptick in rates, and that the high dividend payout will still remain attractive to income investors even in a rising‑rate environment.

b. Dividend Reinvestment

One of KBWD’s biggest strengths, according to the Seeking Alpha analysis, is its dividend reinvestment plan (DRIP). The plan automatically uses incoming cash distributions to buy more shares at the prevailing market price, effectively compounding returns over time. The article quotes a projected 8‑year IRR of ~10 % for a disciplined investor who keeps the DRIP active and reinvests all proceeds.

c. Potential for Management Fees to Decrease

The fund’s current expense ratio of 0.68 % is on the low end for a closed‑end equity vehicle, but the article hints at a possible fee reduction in the next fiscal year if the fund’s net asset value (NAV) climbs to a new high. A lower expense ratio would improve net returns for shareholders, giving KBWD a competitive edge against other income funds.

5. Risks and Caveats

- Interest‑Rate Sensitivity: REITs and BDCs are classic “rate‑sensitive” assets. A sharp increase in rates could compress yields and push valuations lower.

- Credit Risk: BDCs hold a large amount of mezzanine‑level debt. Defaults, especially in a tightening credit environment, could depress the fund’s income stream.

- Concentration Risk: With 55 % of the portfolio in the top 10 holdings, a misstep in one major REIT or BDC could have outsized impact.

- Tax Considerations: While the fund distributes qualified dividends, some income may be taxed at the “non‑qualified” rate, reducing after‑tax yield for certain investors.

6. Bottom Line

KBWD positions itself as a “high‑yield, low‑expense” alternative for investors who are comfortable with the REIT/BDC niche. The Seeking Alpha article paints a compelling picture: a fund that has historically delivered solid total returns, offers an attractive yield that outpaces the broader REIT market, and does so with a disciplined portfolio and a transparent fee structure. The main uncertainties revolve around macro‑economic conditions – particularly interest‑rate movements – and how they might affect the REIT/BDC mix.

For income‑seeking investors who are willing to tolerate the inherent volatility of REITs and BDCs, KBWD could provide a compelling blend of yield and diversification. The key is to keep the DRIP active and stay mindful of the macro‑economic backdrop that will influence the fund’s underlying assets.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4843189-kbwd-concentrated-in-reits-and-bdcs-for-a-competitive-yield ]