Competition is the real cure for high drug prices

Washington Examiner

Washington Examiner

Competition: The Real Cure for High Drug Prices

In a timely piece for The Washington Examiner, the article titled “Competition: The Real Cure for High Drug Prices” tackles one of the most pressing health‑policy challenges of our era—rising medication costs that strain patients, insurers, and the federal budget alike. Drawing on data, expert commentary, and comparative international evidence, the piece argues that the most effective and sustainable solution lies not in price‑setting mandates or complex regulatory overhauls, but in restoring robust competition within the pharmaceutical market.

The Price Puzzle

The article opens by outlining the stark reality of drug pricing in the United States. While the U.S. spends more on pharmaceuticals per capita than any other country, patients often pay a disproportionate share of that cost. The piece cites the Centers for Medicare & Medicaid Services (CMS) that reported an average increase of 10–12% in drug prices over the last decade, with some life‑saving medications—such as certain biologics and specialty drugs—surging even more steeply. The author explains that these price hikes are not merely a function of innovation; instead, they result largely from a lack of competition.

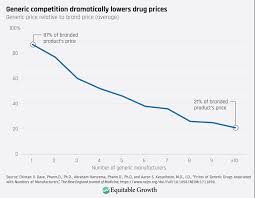

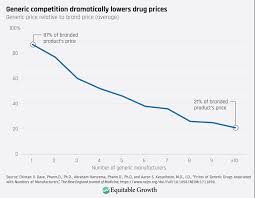

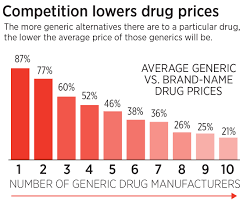

A key statistic referenced is that, of the 2,300 drugs approved by the FDA in 2021, only 18 received generic competition within the first year, compared with 33 in 2001. The article underscores that generics typically lower prices by 70–90% once they enter the market—a fact that has been demonstrated in both the U.S. and other advanced economies.

Why Competition Falters

The piece then delves into the mechanics that suppress competition. First, it points out that the U.S. patent system grants brand‑name manufacturers a de facto monopoly for 20 years, but even after patents expire, manufacturers can extend exclusivity through "patent thickets," secondary patents, and data exclusivity periods that can last up to 5–6 years. The article cites the example of oncology drug Gleevec (imatinib) and its extended patent protection, which delayed generic entry for more than a decade.

Second, the author highlights regulatory bottlenecks. The FDA’s approval process for generics, while rigorous, can be slow and costly for smaller manufacturers. The article references a 2023 RAND Corporation study that estimates generic manufacturers spend on average $60 million in total costs to obtain approval for a single drug—a burden that deters many potential entrants.

Third, the piece discusses the role of “payor” structures. Because many insurers, especially Medicare, rely on negotiated contracts with pharmaceutical companies, the market dynamics differ from the typical free‑market competition. The author points out that insurers often pay a higher “net price” (the amount after rebates and discounts) than the list price, which can discourage generics from competing on price alone.

International Comparisons

To illustrate the benefits of competition, the article turns to other high‑income nations. It cites the United Kingdom’s NHS and Canada’s universal health‑care systems, where drug prices are kept low through centralized price negotiations and the mandatory use of generics. The piece underscores that in the UK, a drug that costs $1,000 in the U.S. may cost only $300 after negotiations, saving the NHS billions annually. By contrast, the U.S. “free‑market” approach has led to price disparities that the author argues are unsustainable.

The article also references the 2022 Inflation Reduction Act (IRA), which includes provisions for Medicare to negotiate drug prices. The author notes that, while this is a step in the right direction, it still does not address the underlying lack of competition that fuels high prices. In fact, the piece argues that negotiated prices without competition can lead to “price setting” that does not reflect true market forces.

Policy Recommendations

Central to the article’s thesis is a set of policy recommendations that prioritize competition:

Streamline Generic Approval: The author urges the FDA to adopt a “step‑up” approval pathway that reduces duplication of work for generic manufacturers, cuts costs, and speeds market entry.

Extend Patent Clarity: The piece proposes a clearer, more predictable patent system that limits secondary patents from extending exclusivity beyond a reasonable period. The author cites the proposed “Patent Reform Act” introduced by Senator Lindsey Graham.

Encourage Biosimilar Entry: The article emphasizes that, like generics, biosimilars can drastically reduce prices for biologic drugs. The author recommends tightening the regulatory requirements for biosimilar approval, drawing parallels to the FDA’s 2015 biosimilar pathway.

Promote Price Transparency: The author argues that a publicly accessible database of net prices, discounts, and rebates would empower payors and patients to make informed decisions and pressure manufacturers to lower prices.

Facilitate Cooperative Competition: The piece suggests that the Department of Health and Human Services (HHS) could pilot programs that allow generic manufacturers to collaborate on production and distribution, especially for specialty drugs.

Conclusion

In closing, the article contends that high drug prices are a symptom of an under‑competitive market. By investing in policy reforms that accelerate generic and biosimilar entry, clarify patent regimes, and increase transparency, the United States can not only lower costs for patients but also foster an environment where pharmaceutical innovation is rewarded in a way that benefits society as a whole.

The article is reinforced by a series of hyperlinks to supporting data, including a 2021 FDA report on generic approvals and a 2023 RAND study on the economic burden of high drug prices. These links provide readers with deeper insight into the statistics that underlie the author’s arguments, cementing the piece’s position as a comprehensive and data‑driven exploration of competition as the real cure for high drug prices.

Read the Full Washington Examiner Article at:

[ https://www.washingtonexaminer.com/restoring-america/faith-freedom-self-reliance/3853618/competition-real-cure-high-drug-prices/ ]