Florida Sports Betting in Legal Limbo: A 2023 Update

Florida Sports Betting Landscape: A Complex Web of Legal Battles, Tribal Control, and Potential Expansion (as of November 2, 2023)

The state of Florida’s sports betting scene is currently a fascinating, and frankly, complicated mess. As of late 2023, it's less a story of booming revenue and widespread access, and more one of legal challenges, shifting control between the Seminole Tribe, and ongoing attempts to establish a stable, sustainable market. This summary, based on recent CBS Sports Betting news coverage, details the current state of affairs, the key players, the legal hurdles, and what the future might hold.

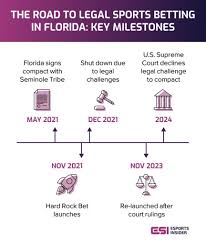

The Short History: A Compact and Subsequent Collapse

For a brief period in late 2021 and early 2022, Florida had mobile sports betting, facilitated by a compact between Governor Ron DeSantis and the Seminole Tribe of Florida. This agreement allowed the tribe to exclusively operate online sports betting statewide, even for wagers placed off tribal lands, through the Hard Rock Bet app. The genius (and ultimately the downfall) of the compact lay in the “hub-and-spoke” theory: all bets were considered to be placed on tribal lands, thus bypassing federal laws requiring state authorization for off-reservation gambling.

However, this innovative approach immediately faced legal challenges. West Flagler Associates, a group of pari-mutuel facilities (including horse tracks and jai-alai frontons) that stood to be excluded from the online market, sued, arguing the compact violated federal Indian Gaming Regulatory Act (IGRA). They asserted the compact illegally expanded gambling beyond tribal lands without a state-wide referendum, a requirement under Florida law.

The Legal Battles: DC Circuit Ruling and Its Consequences

The legal fight escalated, ultimately reaching the D.C. Circuit Court of Appeals. In June 2023, the court affirmed a lower court ruling, decisively striking down the 2021 compact. The court agreed with West Flagler that the “hub-and-spoke” theory was a misinterpretation of IGRA and that the compact illegally extended gambling beyond tribal lands.

This ruling had immediate and significant consequences. Hard Rock Bet ceased operations in Florida on June 29th, leaving the state with effectively no legal mobile sports betting. The Seminole Tribe stopped revenue sharing payments with the state (around $330 million had already been paid), and Florida lost a potentially lucrative revenue stream.

The Current Situation: A Focus on 2024 Legislation and Tribal Control

Following the court ruling, the focus has shifted to the 2024 legislative session. Several potential paths forward are being considered. The Seminole Tribe, despite the legal setback, remains the dominant force in Florida gambling. While they initially indicated they wouldn’t renegotiate the compact in its previous form, they are still engaged in discussions with the state government.

Governor DeSantis has expressed a desire to find a solution that allows for legal sports betting while also addressing the constitutional issues. One possible scenario involves a legislative attempt to authorize sports betting through the tribe and allow for non-tribal operators to apply for licenses, potentially through a competitive bidding process. Crucially, any new legislation would likely need to address the requirement for a statewide voter referendum, potentially bundling sports betting authorization with other gaming-related proposals.

However, the pari-mutuel facilities remain a key player. West Flagler Associates, having successfully challenged the initial compact, is actively lobbying for a more open market. They advocate for a system that allows them to participate in mobile sports betting, arguing that competition will benefit consumers and maximize revenue for the state. They’ve also begun exploring the possibility of placing a constitutional amendment on the ballot to open up the market.

Revenue Sharing and Future Projections

The financial implications of the current impasse are substantial. Florida had previously projected annual revenue of over $500 million from sports betting. The loss of this revenue, combined with the Seminole Tribe’s cessation of revenue-sharing payments, is a significant blow to the state's budget.

Looking ahead, the future of Florida sports betting hinges on the outcome of the 2024 legislative session. While the Seminole Tribe is likely to maintain a significant role, the degree to which non-tribal operators are allowed to participate remains uncertain. A ballot initiative proposed by West Flagler could further complicate matters, potentially pitting proponents of tribal exclusivity against those advocating for a more open market.

Key Takeaways:

- Legal Uncertainty: Florida's sports betting market is currently stalled due to a court ruling invalidating the 2021 compact.

- Tribal Dominance: The Seminole Tribe remains the key player, holding significant leverage in negotiations.

- Legislative Action Needed: The 2024 legislative session will be crucial in determining the future of sports betting in the state.

- Referendum Potential: A statewide voter referendum may be necessary to address constitutional concerns and authorize a new framework.

- Financial Impact: The lack of legal sports betting represents a significant loss of potential revenue for the state.

The situation is fluid, and the coming months will undoubtedly see continued legal maneuvering, political negotiations, and public debate. Florida, once poised to become a major player in the US sports betting market, now finds itself in a period of uncertainty, with the path forward far from clear.

Read the Full CBSSports.com Article at:

[ https://www.cbssports.com/betting/news/florida/ ]